Understanding the problem is the start

of the solution.

Our goal is to help with the ownership end of the housing need spectrum by creating accessible, affordable homes for purchase.

We are focusing on solutions to overcome the persistent & systemic issues driving housing insecurity.

Income

Create micro enterprise

to overcome income needs.

Access

Prioritizing those who've lacked needed resources.

Making work an outlet for community transformation.

Work

Experts

Choosing local leaders, first, from those we serve.

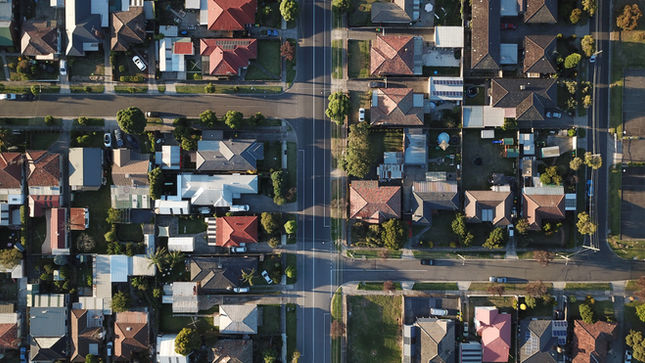

Availability of homes and income levels are the two biggest driving factors of housing affordability.

This only gets more complex when these issues exist in a consumer environment that values bigger homes, less density, and less persons per household.

2x

# of Adults Living Alone in last 50 years ¹

71%↑

Home Size

1970 to 2021 ²

↓500k

Monthly New

Home Starts since 2008 ³

42%↑

New Home Costs since 2020 ⁴

A big thank you to Diane Suhler for her help on compiling these statistics and clarity of narrative.

Simply stated...

Low supply and high demand is driving prices up.

People want bigger homes. They want them on larger lots.

Less homes get built with less density.

And, material and labor costs to build new homes increased 42%.

All affects marginalized communities at larger rates.

Available

Housing

Decrease in new home construction after Great Recession of 2008 has slowed things further.

-

Before 2008: 2m new housing starts per month;

-

Now: 1.5m new housing starts per month

The pandemic has slowed things further and increased the costs to build homes decreasing supply—labor, materials shortages; recent increase in interest rates.

Additionally, there has been a decrease in Manufactured and Prefabricated Homes—Fewer firms making these types of homes: In 1990 there were 100 corporations making the homes in 250 different plants. Today, there are only 45 corporations and 123 plants.

More Factors

Low%

↓ Interest Rates drive↑Home Prices

Size

of Homes Matters

Denials

for mortgages radically favor minority races, especially our black neighbors ⁷

Denial rates for mortgages in the United States from 1st quarter 2019 to 3rd quarter 2022, by race

Income

Levels

Income levels across the nation have a drastic disparity with the rising cost of both Homeownership and Rentals.

The growth rates are drastically growing apart. Seen in the graph below. Additionally, overcoming these issues if you are of a minority racial group is exceptionally difficult.

More Factors

Global

Pressures with COVID, war, etc drive costs ⁵

Upward Mobility

is difficult with income & rental-to-ownership barriers ⁶

Minority Impacts

far outweigh that of majority races, especially for black neighbors